5 Steps To Backtest Without Tradingview Pro.

This only applies to my trading strategy.

TL;DR

- This trading strategy does not require the Tradingview Pro Version. The free version is more than enough.

- Past results do not guarantee future success.

Disclaimer: I am not a financial advisor. The content for this article is purely for educational/research purposes only and is merely based on my personal opinions.

Please note: There will be affiliate links in this article. But it will only benefit both of us. If you do not wish to participate under my affiliate links, please feel free to Google them separately. Cheers!

My unique mechanical consistency strategy allows any working individual to trade without needing to stare at the chart the entire day. Traders can go about their daily routine after setting all necessary parameters like limit buy-sell orders, Stop loss and Take profit levels. After which let the market determine the trade outcome. And let’s be honest, no one likes to pay monthly subscriptions to any software especially if we are financially struggling in trading. Here is how to backtest my strategy without TradingView Pro;

Step 1 — Login to TradingView

Sign up and log in to a free TradingView account.

Search for the pair in the search bar and select the launch chart.

I only trade the Gold-USD pair (XAUUSD) so let's open the XAUUSD chart.

Step 2 — Enable Session Breaks

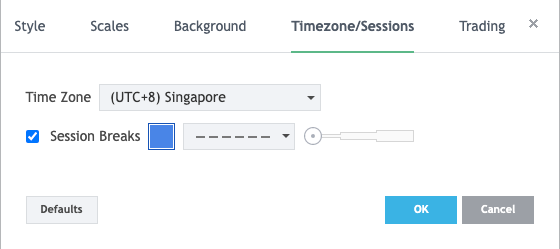

Enable session breaks and select your time zone. Settings > Timezone/Sessions> Check box.

Session Break helps me to identify the daily opening candle. We need the first candle of the day to plot our parameters.

Step 3 — Configure Fibonacci Retracement tool

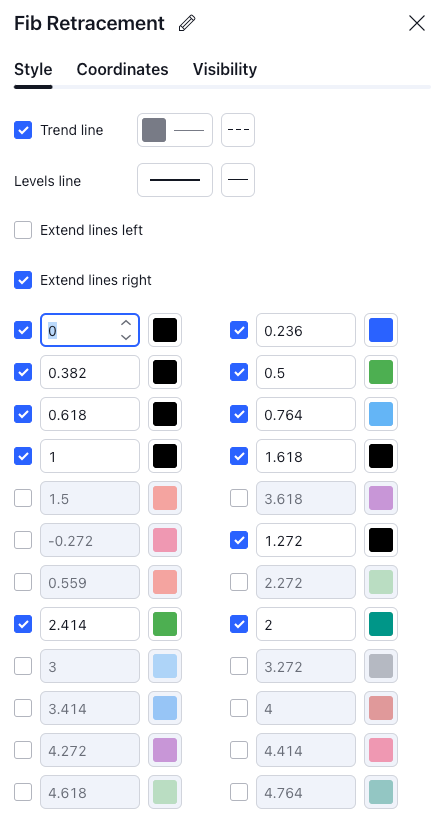

Add Tools such as the Fibonacci Retracement tool to your favourite. Select and hold the tools (left side on the charts) > Select the stars to favourite for easy access. You can use my configuration below.

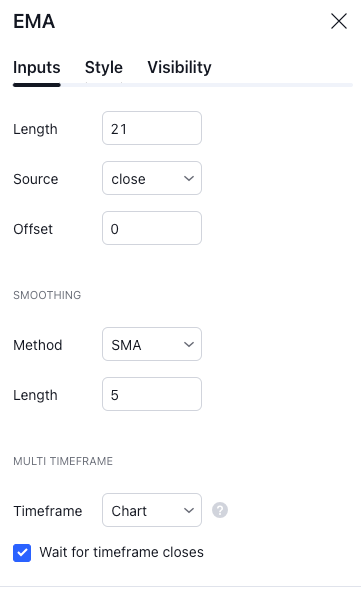

Step 4 —Enable 21 Exponential Moving Average (EMA) indicator.

If the first candlestick of the day closes above 21 EMA, our trade bias is Long/Buy direction.

If the first candlestick of the day closes below 21 EMA, our trade bias is Short/Sell direction.

Step 5 — Start backtest by plotting.

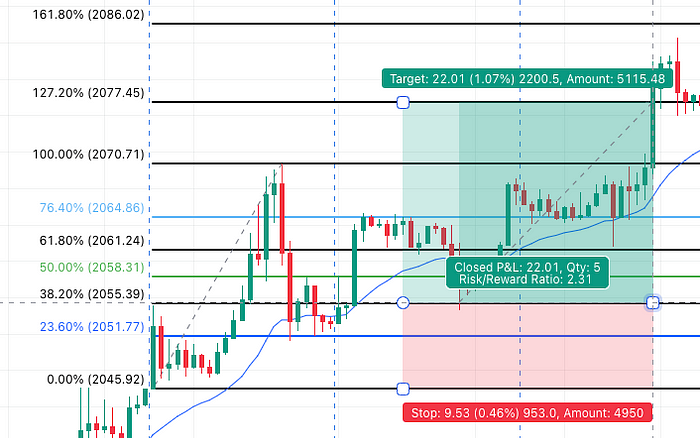

- Identify if the day's first candlestick closes above or below the 21 EMA.

- Plot Fibonacci Retracement on the previous Daily highest and lowest points, 100% @ highest to 0% @ lowest point.

- Use Long/Short position tool to measure and determine the trade result.

6. Record down all backtest results in a free Google sheet or docs and document the trading journey. Using the data to determine the win rate and total return.

7. Repeat the entire process and backtest whenever you wish.

This is much I would have earned if I traded for the entire year of 2023!

I went ahead and backtested my strategy on Gold for the entire past year. Read this article here [Link]

EndNote

As a trader, we must understand that there is no “holy grail” strategy, even the “best” strategy will result in loss from time to time.

This is why we need to back-test as much as possible to get more accurate results on the effectiveness of the strategy. Backtests also give traders the confidence to trade and always will be consistent using the same strategy.

Hope this strategy works well for every struggling trader out there. Because I was once a struggling trader, I completely understand the difficulties when trading in the Forex market.

Success is not the result of making money; earning money is the result of success and success is in direct proportion to our service. — Earl Nightingale

Affiliate Links / Connect With Me

- Connect with me on Linkedin

- Read my blog post on Medium or Blog

- Best Charting Tool: TradingView SuperChart

- Thank you for Buying Me A Coffee:)

- Useless fun fact Youtube Channel

- The prop firm I am using: the5ers Prop Firm

- Collect Free Stock from Webull