Mechanical Consistency Weekly Review 10; -6% Return.

Another losing week… 18 to 22 Sept 2023

TL;DR

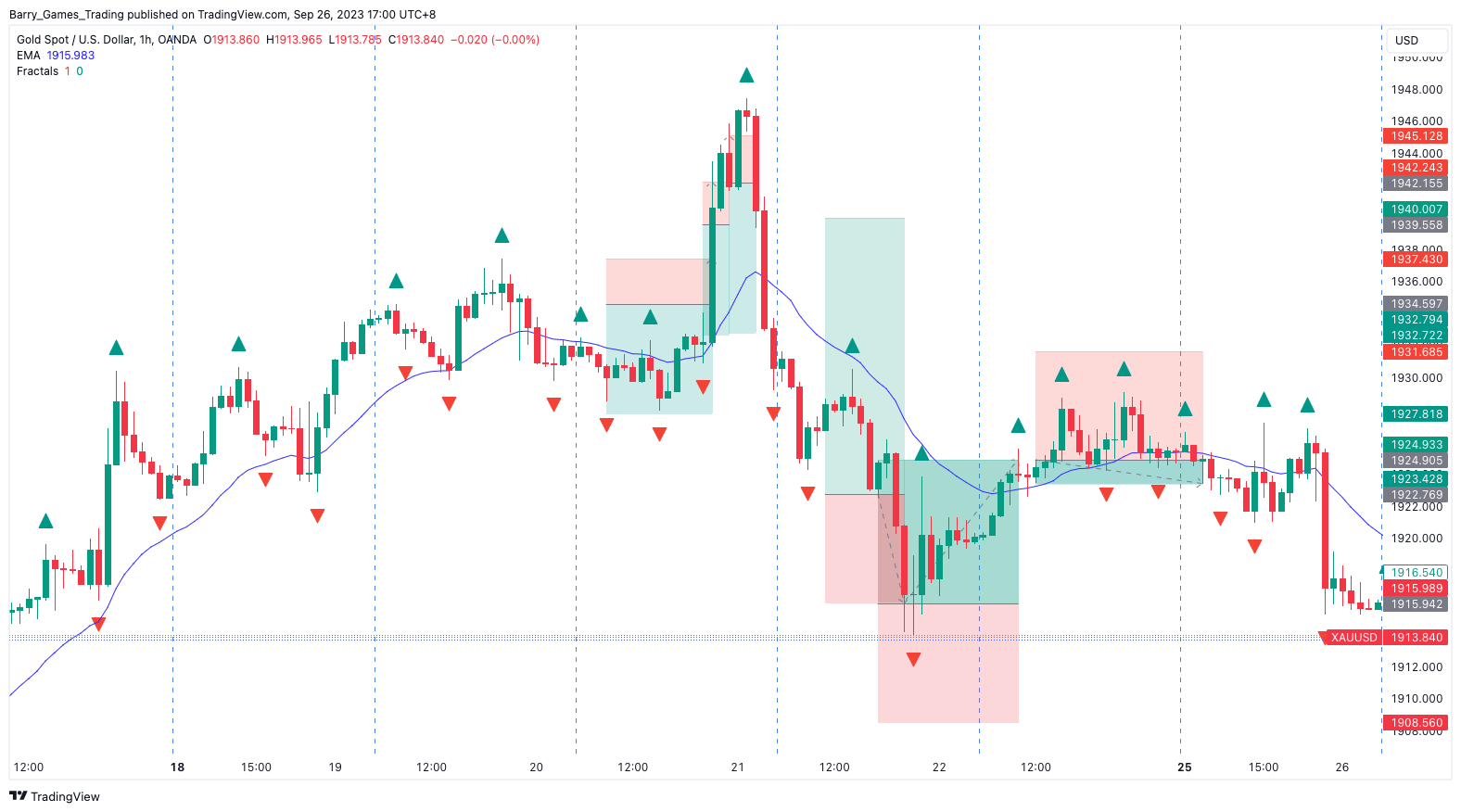

- Total Profit of approximately $-660 (around -6.60%) for the 3rd week of September 2023.

- Total 6 trades, 2 wins & 4 losses.

- 1-hour Timeframe, Oanda, XAUUSD(Gold), $10,000 Capital, $200/ 2% per trade.

- Mechanical Consistency Trading Strategy; Purely rule-based strategy, zero guesswork, zero analysis.

Disclaimer: I am not a financial advisor. The content for this article is purely for educational/research purposes only and is merely based on my personal opinions.

Please note: There will be affiliate links in this article. But it will only benefit both of us. If you do not wish to participate under my affiliate links, please feel free to Google them separately. Cheers!

This has been one of the most challenging trading weeks since I started using the mechanical consistency trading system. I’ve experienced missed opportunities, and my losses for the week can be attributed to factors such as PMI data and FOMC data. Let’s take a closer look at what happened.

Monday (18 September 2023)

0x Trade

Daily bias: Uptrend

Monday was relatively quiet, none of my limit orders got triggered.

Tuesday (19 September 2023)

0x Trade

Daily bias: Uptrend

I encountered another missed opportunity on Tuesday when the price came close to triggering my mean reversion trade at the 127.20% Fibonacci level. Unfortunately, my limit order did not trigger, causing me to miss out on the entire trade. I could have taken profit at Take Profit 1 if it had gone through.

Wednesday (20 September 2023)

3x losing trades

Daily bias: Downtrend

My worst fear scenario unfolded when both my retracement and mean reversion limit orders were triggered, resulting in immediate losses. This unfortunate outcome was primarily due to the release of FOMC data in the United States. Nevertheless, I see this as a valuable learning experience. I’ve made a note to myself to avoid trading on days when there is significant economic data like FOMC, PMI, and Non-Farm Payroll releases.

Thursday (21 September 2023)

1x Partial win trade & 1x losing trade.

Daily bias: Downtrend

Although Thursday did not witness any major news that directly impacted the price, the effects of the FOMC data continued to linger in Thursday’s price action. The price exhibited a sharp downward trend, causing me to lose my first mean reversion trade. However, I was fortunate that my second mean reversion trade held and reversed the price to the upside, allowing me to secure Take Profit 1. I had to adjust Take Profit 2 due to a clash with the Friday setup, but fortunately, the price still managed to reach TP 2.

Friday (22 September 2023)

1x Partial win trade

Daily bias: Downtrend

Friday’s trade could have yielded full profit if it weren’t for the clash with Monday’s setup. This was due to the influence of Monday’s daily bias, which led me to adjust the take-profit parameters for the Friday trade. As a result, the trade concluded with a small profit, but I am still content with the outcome.

Endnote

In reflection on this eventful trading week, it’s clear that both missed opportunities and unexpected market movements tested the limits of my trading strategy. Despite encountering challenges, I have gained valuable insights and lessons from these experiences. It’s important not to lose sight of the bigger picture and to remain committed to refining and improving the strategy. I firmly believe that with continued dedication and a commitment to learning, I can overcome these hurdles and achieve success in my trading endeavours. Therefore, I am determined not to give up on my trading strategy and will continue to adapt and evolve to become a more resilient and successful trader.

Learn My Strategy For Free

As a full-time working individual, I do not have the time to constantly monitor the charts and look for the “perfect” trading opportunity. This is why I adopted the mechanical trading strategy to earn extra money. This approach eliminates the need for extensive technical or fundamental analysis and removes any guesswork. It is a 100% Mechanical rule-based strategy, ensuring disciplined and consistent decision-making.

If you want to learn my strategy, please visit my blogging site, link down below. Thank you!

Link: https://barrygamestrading.ghost.io/

Linkedin | Medium | TradingView SuperChart | Blog | Buy Me A Coffee:)