Mechanical Consistency Weekly Review 6; +6% Return.

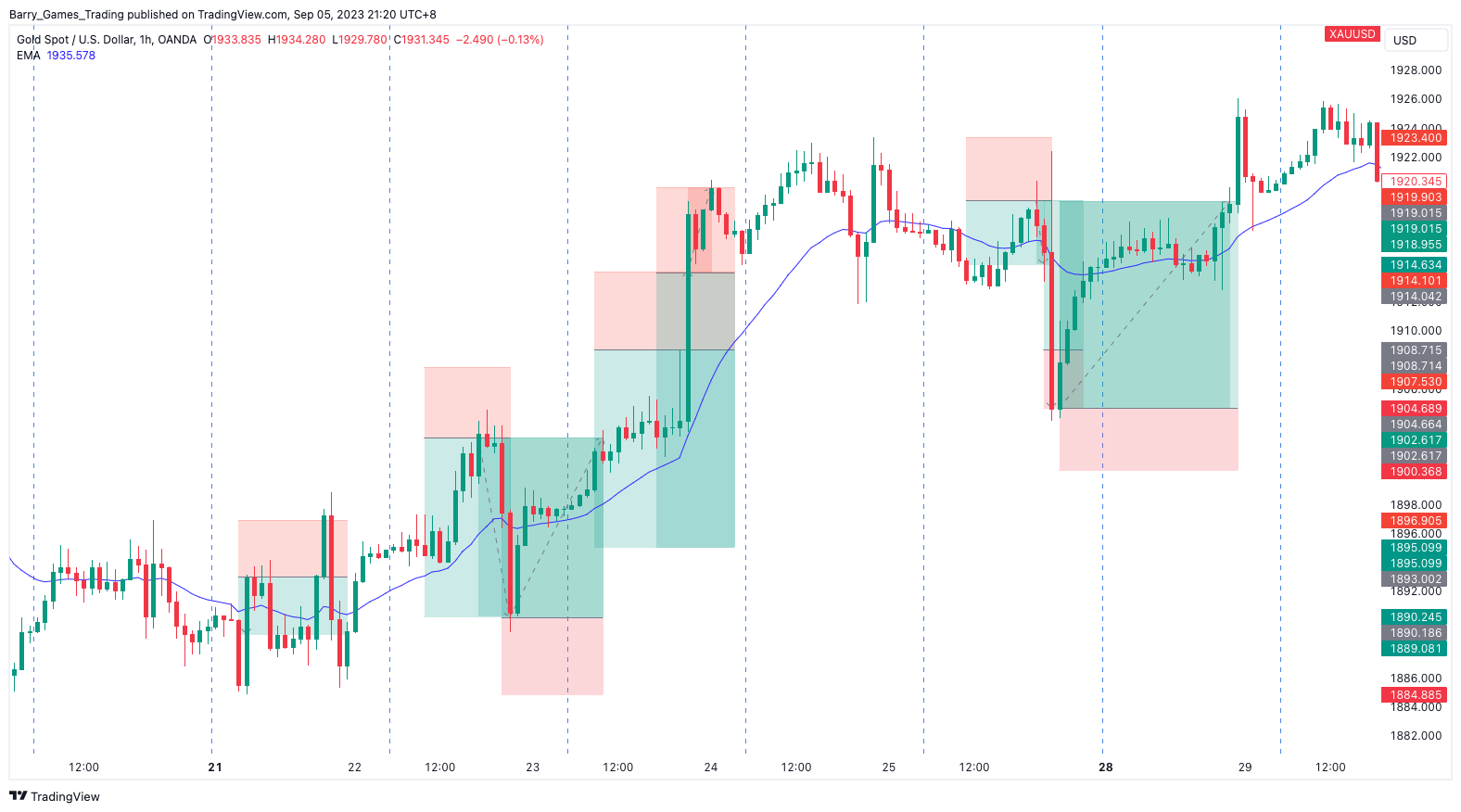

Getting the hang of it! Trade Review 21 Aug to 25 Aug 2023.

TL;DR

- Total Profit of approximately $600 (around +6%) for the 3rd week of August 2023.

- Total 8 trades, 5 wins & 3 loss.

- 1-hour Timeframe, Oanda, XAUUSD(Gold), $10,000 Capital, $200/ 2% per trade.

- Mechanical Consistency Trading Strategy; Purely rule-based strategy, zero guesswork, zero analysis.

Disclaimer: I am not a financial advisor. The content for this article is purely for educational/research purposes only and is merely based on my personal opinions.

Please note: There will be affiliate links in this article. But it will only benefit both of us. If you do not wish to participate under my affiliate links, please feel free to Google them separately. Cheers!

The more I engage in trading, the clearer I perceive the profound significance of maintaining mechanical consistency within this domain. As this week unfolds, the market is growing increasingly volatile, driven by an influx of data from the United States. Let’s review trades for this week.

Monday (21 August 2023)

1x Win trade.

Daily bias: Downtrend

On Monday, the market began to shift its momentum in an upward direction. I managed to lock in some profits early, just before the market started to move against my initial daily bias.

Tuesday (22 August 2023)

2x Win trades

Daily bias: Uptrend

On Tuesday, our trading performance was exceptional, demonstrating the remarkable effectiveness of my mechanical strategy. The first mean reversion trade was initiated with minimal drawdown, swiftly transitioning into profit. Similarly, the second retracement trade was executed flawlessly, experiencing no drawdown, and reaching both take-profit levels within just one day

Wednesday (23 August 2023)

2x Losing Trades

Daily bias: Uptrend

I experienced my first loss of the week due to the sudden and aggressive rise in prices caused by the US market data. This unexpected development led to losses in both of my mean reversion trades almost immediately. This situation highlights a key aspect of my strategy: not all trades will be profitable, but it’s crucial to appreciate the consistency factor in trading. I’m optimistic that we can regain some of the losses in the next trading session.

Thursday (24 August 2023)

0 trades

Daily bias: Uptrend

Thursday saw relatively calm price movements following the sharp market activity from the previous day, and as a result, none of my trade parameters were triggered.

Friday (25 August 2023)

2x Win 1x Loss trades.

Daily bias: Downtrend

On Friday, the impact of market data continued to affect my trading. I was only able to secure partial profit for the first retracement trade before significant volatility triggered my stop loss at breakeven. Similarly, the second mean reversion trade resulted in a loss primarily due to the same market volatility. However, the third mean reversion trade managed to weather the storm and eventually pushed the price into profit, hitting both take-profit levels.

Endnote

In conclusion, this week presented a mix of challenges and successes in our trading endeavours. While we faced a loss earlier in the week due to unexpected market movements, we also demonstrated the resilience of our strategy by recouping losses and securing profits in subsequent trades. It’s important to recognize that trading involves both ups and downs and maintaining consistency and adaptability in our approach is key to long-term success. As we move forward, we’ll continue to analyze and refine our strategies to navigate the ever-changing market conditions with confidence and determination.

Learn My Strategy!

As a full-time working individual, I do not have the time to constantly monitor the charts and look for the "perfect" trading opportunity. This is why I adopted the mechanical trading strategy to earn extra money.

This approach eliminates the need for extensive technical or fundamental analysis and removes any guesswork. It is a 100% Mechanical rule-based strategy, ensuring disciplined and consistent decision-making.

If you want to learn my strategy, please visit my blogging site, link down below. Thank you!