Mechanical Consistency Weekly Review 9; -3% Return.

Experienced some missed opportunities…

TL;DR

- Total Profit of approximately $-320 (around -3.20%) for the 2nd week of September 2023.

- Total 7 trades, 2 wins & 5 losses.

- 1-hour Timeframe, Oanda, XAUUSD(Gold), $10,000 Capital, $200/ 2% per trade.

- Mechanical Consistency Trading Strategy; Purely rule-based strategy, zero guesswork, zero analysis.

Disclaimer: I am not a financial advisor. The content for this article is purely for educational/research purposes only and is merely based on my personal opinions.

Please note: There will be affiliate links in this article. But it will only benefit both of us. If you do not wish to participate under my affiliate links, please feel free to Google them separately. Cheers!

My mechanical consistency strategy has experienced some missed opportunities. In some instances, certain trades underperformed relative to our expectations, while other trades triggered stop-losses only to subsequently resume in the intended direction. Let’s review my trades for this week.

Monday (11 September 2023)

1x Loss Trade

Daily bias: Downtrend

This marks my first loss of the week. I entered this retracement trade with the intention of capitalizing on the downtrend. Unfortunately, the price triggered my stop loss before eventually moving in the anticipated direction.

Tuesday (12 September 2023)

1x Lose trade & 1x Partial Win trade

Daily bias: Downtrend

This represents my initial missed opportunity of the week. The price retraced to the 50% Fibonacci level, while my limit order was positioned at the 61.8% Fibonacci level. Regrettably, the price did not reach the level required to activate my retracement trade before proceeding in the direction aligning with my daily bias. Consequently, the only trades that were executed were mean reversion trades. The first mean reversion trade resulted in an immediate loss, although I managed to secure a partial win with the second mean reversion trade.

Wednesday (13 September 2023)

0x trade

Daily bias: Downtrend

Due to the market’s pronounced price volatility on Tuesday, my predefined trade parameters never came into play. The market remained within a narrow range-bound movement, preventing my trades from being triggered.

Thursday (14 September 2023)

1x Full win trade & 1x Partial win trade

Daily bias: Downtrend

Thursday turned out to be the sole winning day of the entire week but with a missed opportunity. My retracement trade executed flawlessly, achieving both Take Profit levels as expected. My mean reversion trade was triggered and swiftly reached Take Profit 1 thanks to heightened market volatility. However, owing to this same volatility, I decided to shift my stop loss to the entry point. Unfortunately, the price hit my stop loss before making the anticipated upward move that could have reached my second Take Profit level.

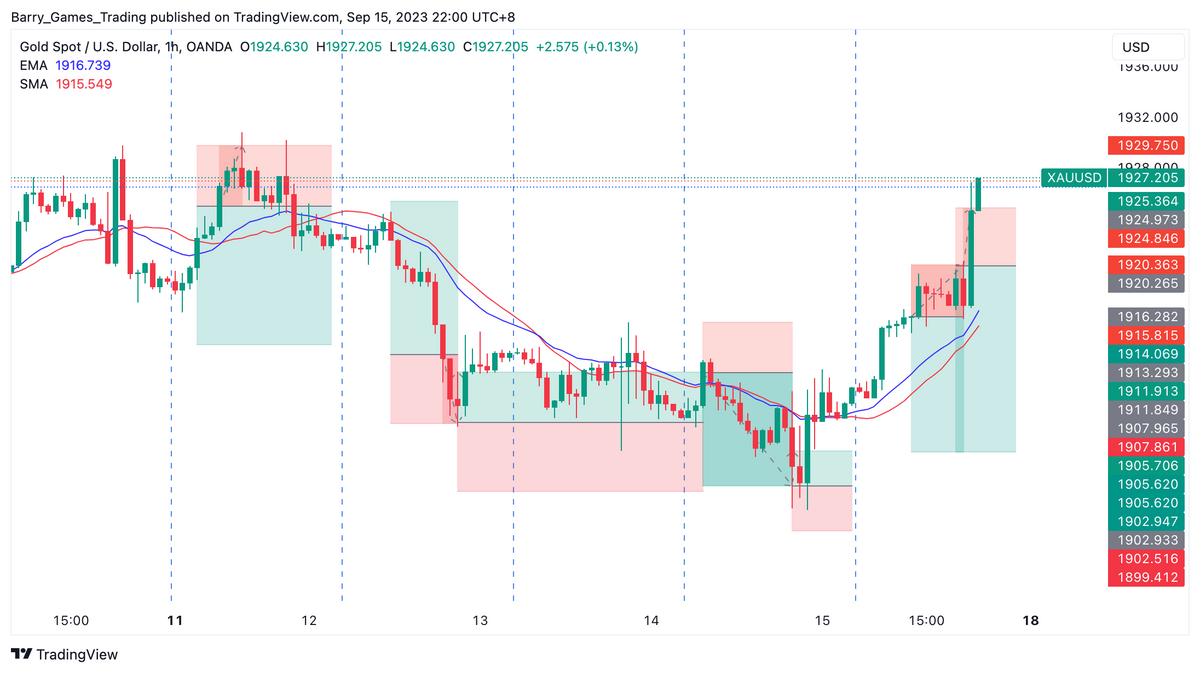

Friday (15 September 2023)

2x losing trades

Daily bias: Uptrend

Despite a shift in the daily bias toward an uptrend, my retracement trade failed to trigger. Instead, both of my mean reversion trades were executed, but they faced a substantial challenge due to significant volatility resulting from economic data. The price surged dramatically, quickly hitting all of my stop losses.

Endnote

Despite this being a losing week, I remain confident in the overall effectiveness of the strategy. It’s essential to view this period as a temporary setback and continue refining the approach for better results in the future.

Learn My Strategy For Free

As a full-time working individual, I do not have the time to constantly monitor the charts and look for the “perfect” trading opportunity. This is why I adopted the mechanical trading strategy to earn extra money. This approach eliminates the need for extensive technical or fundamental analysis and removes any guesswork. It is a 100% Mechanical rule-based strategy, ensuring disciplined and consistent decision-making.

If you want to learn my strategy, please visit my blogging site, link down below. Thank you!

Link: https://barrygamestrading.ghost.io/

Linkedin | Medium | TradingView SuperChart | Blog | Buy Me A Coffee:)