A Step-by-Step Breakdown of My Unique Mechanical Consistency Trading Strategy

An introduction to my trading strategy.

TL;DR

- Trade the Forex market without monitoring the chart.

- A strategy that works perfectly for working individuals!

- A Set & forget strategy; let the market determine the trades.

- Paid Content; Revealing my profitable strategy!

Disclaimer: I am not a financial advisor. The content for this article is purely for educational/research purposes only and is merely based on my personal opinions.

Please note: There will be affiliate links in this article. But it will only benefit both of us. If you do not wish to participate under my affiliate links, please feel free to Google them separately. Cheers!

Tools I use for trading

Trading Platform: Oanda.

Markets/Pair: Forex Market / Gold (XAU/USD)

Charting: Default Free Tradingview charts, 1-hour timeframe, 2x Default Fibonacci. 21 EMA

Before Market Open (Gold, XAUUSD)

As I live in Singapore (UTC+8), the market open timing might differ from yours. The market opens at 6 am (UTC+8) in Singapore for Gold, XAUUSD.

- You can check your market open timing by changing the time zone at the bottom right corner of the Tradingview page. Mine is shown as (UTC+8, Singapore time).

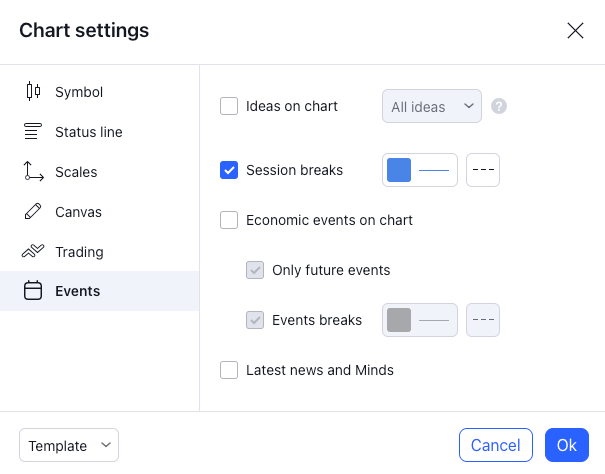

2. Enable the Session break tool from Tradingview setting options.

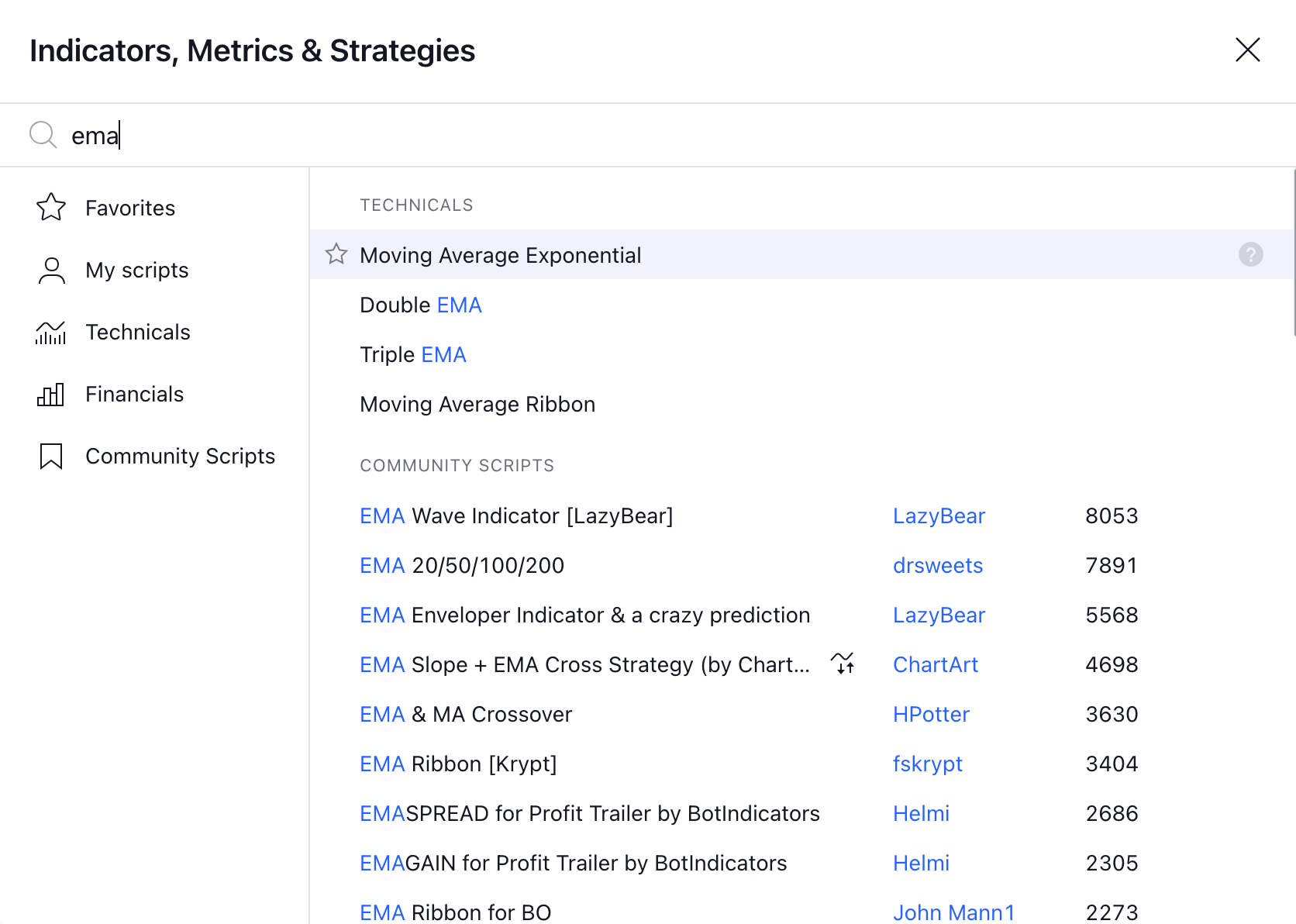

3. Enable EMA from the indicator tools and change the length to 21.

General Trading Strategy Theory

This mechanical trading strategy uses a trend-following approach that utilizes two trading systems. A retracement trading strategy and a mean reversion trading strategy. These two system aims to capitalize on price retracements back to significant psychological levels for maximum profit.

In a trending scenario, the price will always retrace and often exhibit significant reactions around 61.8%, 50%, 23.6%, 127.20% & 161.80% of the Fibonacci levels. In a retracement trade, the price would usually retrace back to 61.8% or 50% Fib level before continuing the trend. In a mean reversion trade, the price would sometimes stretches too far away from the moving average to 127.20% or 161.80% before reverting back to the moving average again.

Therefore, by placing our limit orders at these Fibonacci levels, we can align our trades with the trend established by the moving averages. All these limit orders and parameters can be setup right after the first-hour candlestick closes every morning, allowing an individual to carry on their daily activities without the constant monitoring like day traders.

The Official Strategy Guide

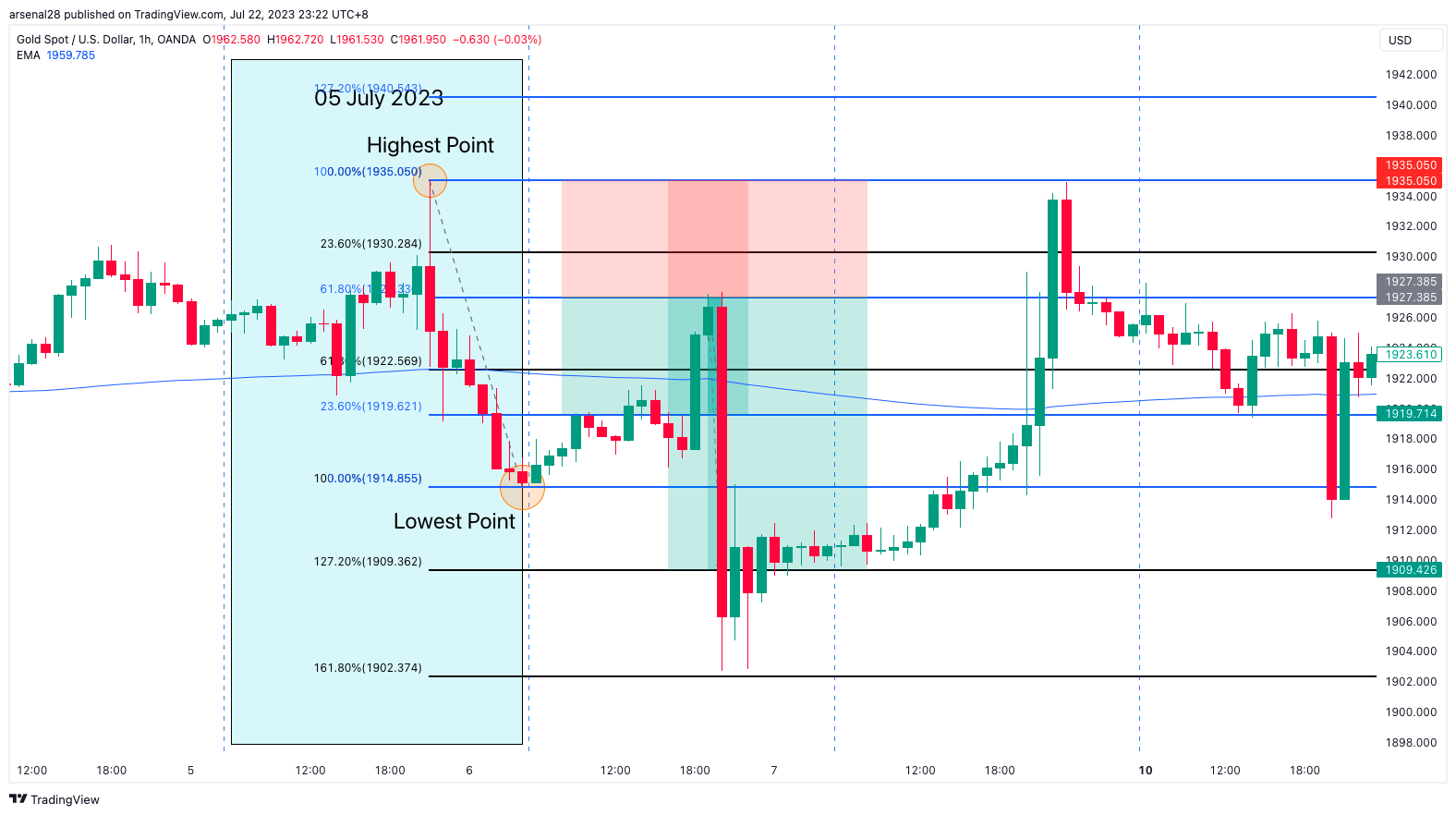

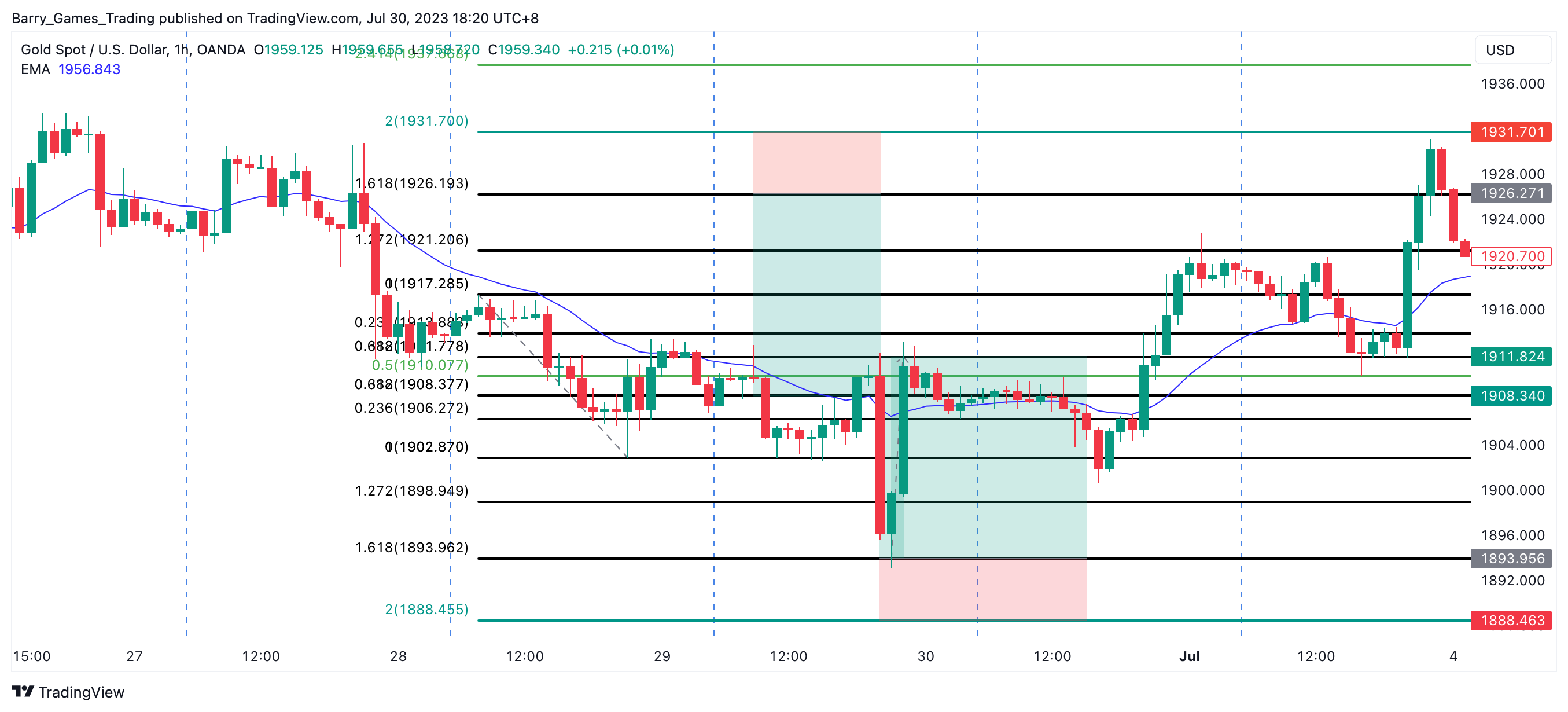

I will be cherry-picking a "perfect" trading day on 06 July 2023, so that you guys can understand the concept better. Let's imagine that the first-hour candle (6 am to 7 am candle) has been completed and closes below 21 EMA(blue line), which means our daily bias will be downtrend/sell/short.

The chart below shows exactly what happened on 06 July 2023 with my trading strategy where both trades profit roughly 1.65x per trade. I can capture the price movement without constantly monitoring the charts and without much technical and fundamental analysis. Both trades are limit orders that I have placed after the first candlestick of the day has been closed. Let's break down the steps.

Step 1

Mark out the previous day's (05 July 2023, blue box) highest to lowest point using the 2x Fibonacci tool.

Step 2

With both the Fibonacci Level line up perfectly, we will set up our trading parameters such as Limit Buy and Sell Entry, Stop Loss and Take Profit 1&2 for our trades. We will enter 5 trades daily, the sequence does not matter as long as all 5 trades are set up before we move on with our day.

Note: In an ideal situation, not all 5 trade setups will be triggered. Hence it is recommended to set the timer to expire the next day so that we can repeat with a new trade setup the next time.

First Trade Setup (Retracement Trade)

This first trade setup depends on whether the first candle closes below or above 21 EMA. From our example chart above, the first-hour candle closes below the 21 EMA, which means we will place a sell-limit order on...

Entry: $1927.336 (61.80% level of the blue Fibonacci)

Stop Loss: $1935.050 (100% level of the blue Fibonacci)

Profit 1: $1919.621 (23.60% level of the blue Fibonacci)

Profit 2: $1909.362 (127.20% level of the black Fibonacci)

Note: Always a good practice to shift Stop Loss to Entry after Profit 1 has been secured!

Second Trade Setup (Mean Reversion Trade)

The second and third trades do not depend on 21 EMA. We will just have to mechanically place these trades daily to capture the price movement. The theory is the price would usually have a strong reaction at 127.20% Fibonacci Level and retraces after a significant move to the downside.

Entry: $1909.362 (127.20% level of the black Fibonacci)

Stop Loss: $1902.374 (161.80% level of the black Fibonacci)

Profit 1: $1914.855 (100% level of the blue Fibonacci)

Profit 2: $1927.386 (61.80% level of the blue Fibonacci)

Third Trade Setup (Mean Reversion Trade)

As you can see, the price did not reach the top 127.20% Fibonacci Level, which means the trade setup will be invalid and we can cancel our limit sell order the next day on 07 July 2023.

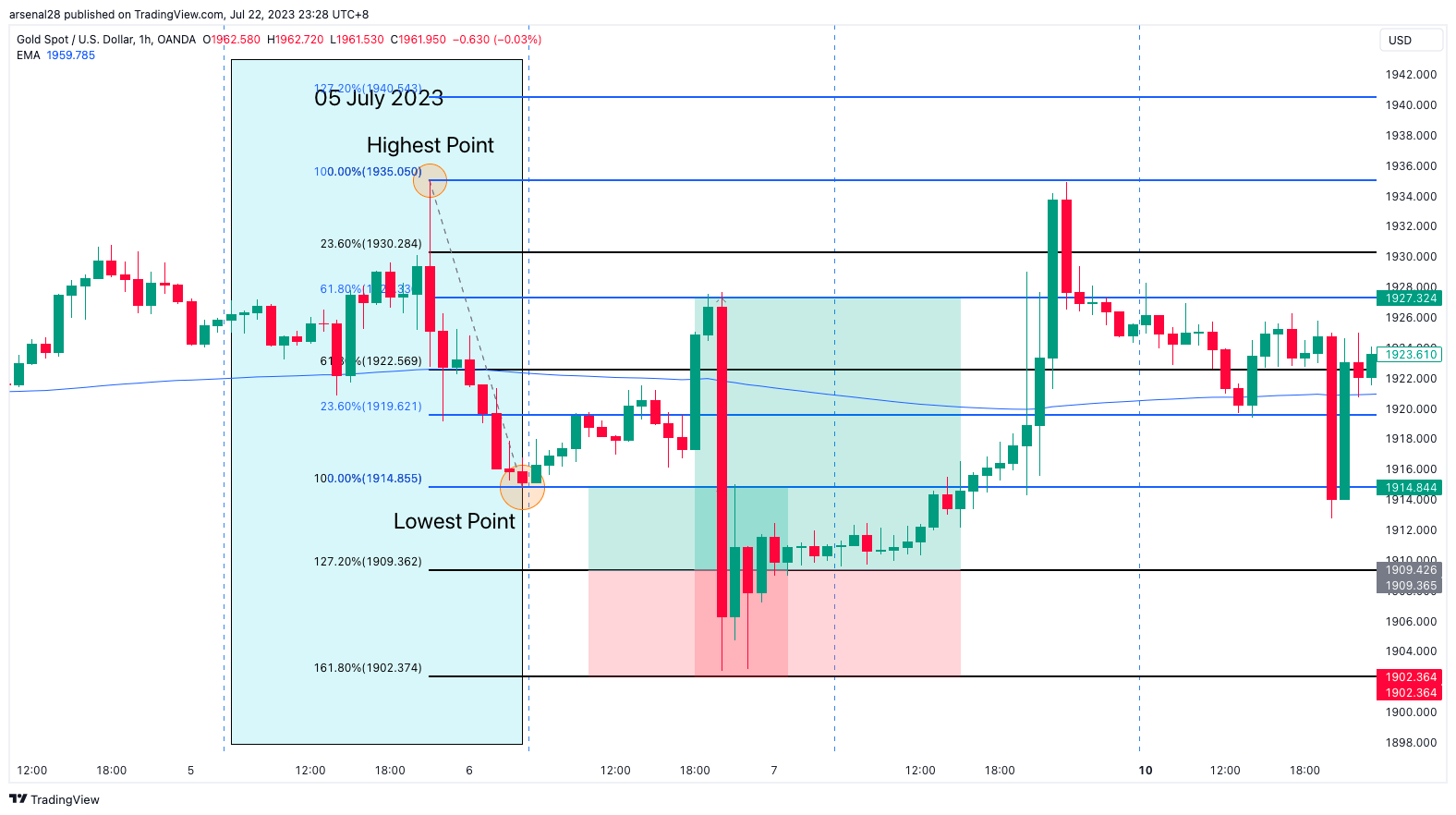

4th and 5th Trades Setup (Mean Reversion Trades)

I have picked 29 June 2023 to better illustrate the 4th and 5th trades setup. As the price made another further push downward and broke our trade at 127.20% Fibonacci level, hit our stop loss and immediately triggered our 5th trade at 161.80% Fibonacci Level. The price then reverses all the way to both of our take profit levels. This last trade essentially turns the tide around from a losing day to a profitable day. However, the 4th and 5th trades setup does not happen every day and some trades will be even ended up losing but it is will beneficial to have places as the "last line of defend" to recover from the losses.

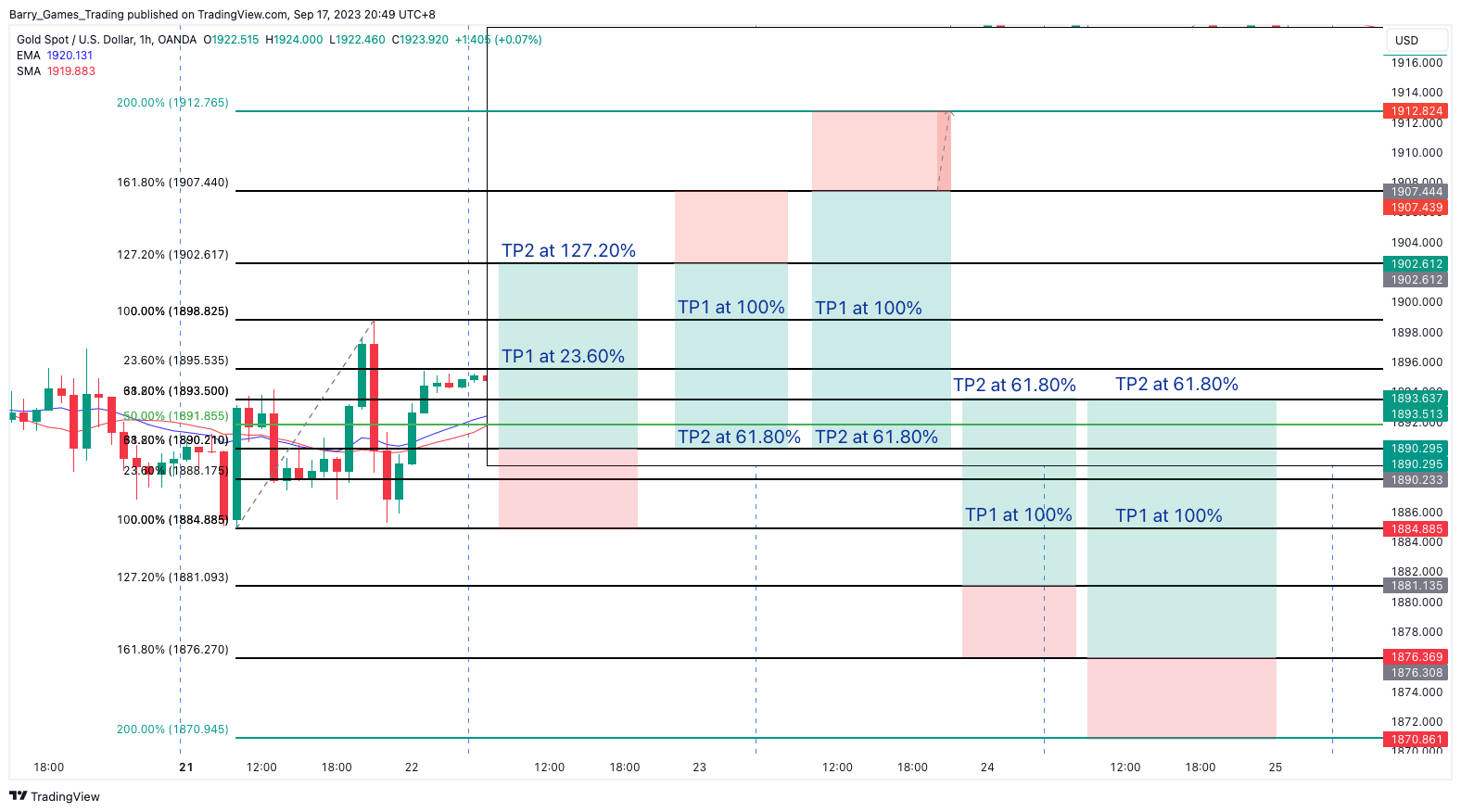

Daily Setup Parameters Example

This is what my trade parameters will look like every morning after the first candlestick closes. There will always be a total of 5 limit orders per day. 1x retracement trade, 4x mean reversion trades. Again I am cherry-picking a good trading day that was executed perfectly.

Trades Example

The theory is essentially the same. With the first-hour candle closing above the 21 EMA(blue line), only long trade is allowed for our retracement trade. Therefore, I started with 5x limit orders, only 2x orders got triggered and resulted in profit. All these parameters were set at 8 a.m. without any fundamental or technical analysis, purely using mechanical rules.

Here's the essential part of my trading strategy! The Mechanical Consistency.

My trading strategy is an example of unwavering consistency. It operates on a highly mechanical and rule-based framework, leaving no room for guesswork or impulsive decisions. Every trade is executed in strict adherence to the established rules, maintaining a steady and disciplined approach day in and day out. By remaining resolute in our commitment to the strategy, we can expect the money to flow steadily and consistently in our favour.

However…

It's crucial to recognize that there is no "Holy Grail" or infallible trading strategy with a 100% win rate. Inevitably, there will be periods when we experience multiple losses. Consequently, it becomes paramount to approach trading with caution and implement proper risk management measures.

I adhere to the practice of allocating a maximum of 1% to 2% of my capital to each trade. This conservative approach helps protect my overall capital and minimizes the impact of potential losses.

Consistency plays a pivotal role in trading success. Even when faced with consecutive losses, it is imperative to resist the temptation to deviate from the established strategy. By maintaining consistency and adhering to the predetermined plan, we increase the likelihood of encountering profitable trades in due course.

Ultimately, trading requires a balanced approach that acknowledges the absence of a foolproof strategy and embraces risk management principles. By exercising caution, managing risk effectively, and staying consistent, we enhance our ability to navigate the market with greater resilience and strive for long-term profitability.

Endnotes

Thank you for subscribing to my paid content. Trading is simple in concept but definitely not easy to execute successfully. It's essential to recognize that strategies can yield different results for different individuals.

Before fully adopting any new strategy, it's indeed prudent to conduct thorough backtesting. Backtesting allows us to assess the strategy's historical performance and gain insights into its potential effectiveness. This process helps identify strengths, weaknesses, and areas for refinement.

While the strategy may work well for you, it's essential to acknowledge that individual trading styles, risk tolerances, and market conditions can vary. Therefore, it's always recommended to personalize and adapt any strategy to fit your circumstances.

By approaching trading with a combination of careful analysis, risk management, and personalization, we increase our chances of finding a strategy that aligns with our goals and suits our trading styles. Wishing you success in your trading endeavours, and may the guide benefit both of us.

Affiliate Links / Connect With Me

- Connect with me on Linkedin

- Read my blog post on Medium or Blog

- Best Charting Tool: TradingView SuperChart

- Thank you for Buying Me A Coffee:)

- Useless fun fact Youtube Channel

- The prop firm I am using: the5ers Prop Firm

- Collect Free Stock from Webull